Understanding pet parents’ needs and behaviors is key to offering the best nutrition for their companions. That’s why we conducted the survey “Inside a Pet Parent’s Mind” across France, the UK, the USA, Canada, Brazil, and Mexico*.

The result? Six distinct pet parent profiles that shape today’s pet food market and reveal exciting opportunities for brands.

From Vera, the Vet Follower, to Tess, the Tasty at a lower cost, let’s meet the faces of today’s pet parenting.

Meet Vera, the Vet follower

Vera is the most common pet parent profile as it represents 31% of pet owners worldwide.

Mainly from Gen X and living in a big city, Vera seeks out pet foods that benefit her pet’s health. She typically feeds her pet dry kibble, follows recommendations from her veterinarian (brand and quantities), and rarely gives other additional foods to her pet (e.g. leftovers and treats). In fact, she is the lightest user of wet foods and treats.

Although Vera wants to provide her pet with a healthy, nutritious and balanced diet, nutrition is not her field of expertise. Consequently, she prefers to trust her vet and rely on them to assist her in making her decision. She is loyal to the premium to super premium kibble brands that she purchases and typically shops for her pet’s food at specialized stores (pet shops or vet clinics).

In addition, Vera is the least driven by price and taste. With a veterinarian’s recommendation, she would be willing to pay more for a diet that is better suited to her pet’s needs.

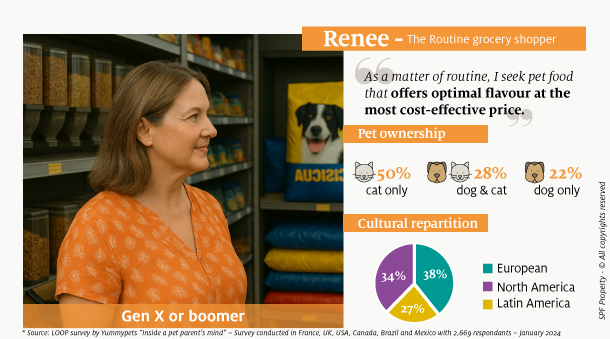

Meet Renee, the Routine grocery shopper

Renee is the second pet parent profile as it represents 20% of pet owners worldwide.

Renee is the oldest pet parent (Gen X or Boomer) and mainly owns a cat. Choosing the right pet food is difficult for her. She doesn’t necessarily know what a “good” pet food is. When choosing what pet food to purchase, she is more driven by the taste than its health benefits. She gives her pet both dry kibble and wet food and occasionally treats.

Her main levers of choice are price, then brand. She purchases low-priced to mid-priced pet food at the super/hypermarket, usually while shopping for her groceries. Renee is a routine shopper. She is the most brand-loyal and usually chooses the same brands without hesitation. When she changes her pet food, she replaces it with a product at the same price or cheaper.

She is one of the least willing to pay more for a diet that is better suited to her pet’s needs.

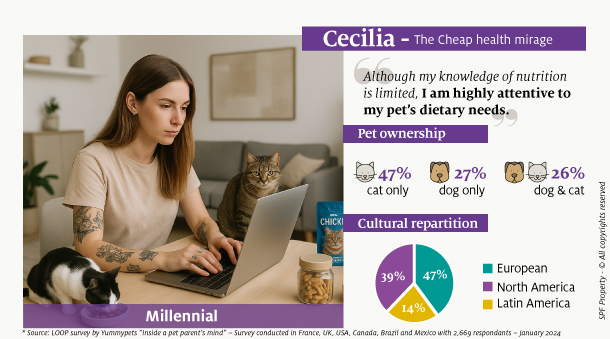

Meet Cecilia, the Cheap health mirage

Cecilia represents 18% of pet owners worldwide.

Cecilia is a Millennial without children, strongly invested in her bond with her pet (mainly cat). She gives special care to her pet food choice.

Driven by the desire to keep her pet in good health, she spends time ensuring that she chooses the best diet for her pet. She reads information on the packaging and online, where she shops. She gives her pet dry food and treats and is the heaviest user of wet food. She is also the most satisfied with her current pet food.

Cecilia gives high importance to ingredient quality and values the presence of meat in the recipe (real meat, protein source, meat ratio, fresh meat). She is also sensitive subjects related to naturalness, grain- free, reduced list of ingredients, country of origin.

Nevertheless, she declares purchasing premium products while purchasing standard brands, which indicates her illusions about her own pet food knowledge.

Meet Erin, the Eco-conscious nutrition seeker

Erin represents 12% of pet owners worldwide.

Erin is a young city girl (Gen Z or Millennial), who feels strongly about feeding her pet correctly. Healthy and natural ingredients are key drivers for her.

As she is eco-conscious, she spends time investigating nutritional information and food quality (source of protein, meat ratio, a limited list of ingredients, low impact on environment…). She carefully selects the products she purchases, whether it be dry kibble, wet food or treats, and usually buys premium to super premium food online or at pet shops. Erin is strongly driven by the presence of real meat, organic ingredients and free-from products. She can cook for her pet and regularly adds supplements to cover all facets of her pet’s health and nutrition.

She is the best target for alternative proteins and new pet food technologies (dehydrated, freeze-dried, frozen). She is the most willing to change her current brand for a more expensive diet that is better suited to her pet’s needs.

Meet Helena, the Home cook

Helena represents 11% of pet owners worldwide.

Helena is a Millennial or Gen X pet parent (mainly dog), who is not influenced by others and trusts her own instincts about feeding her pet, for whom she prepares homemade meals.

She is driven by the desire to keep her pet healthy (with a strong focus on gut health) and to find pet foods that bring the best nutrition. She uses natural ingredients and gives importance to high protein content, real meat and the absence of controversial ingredients (non-GMO, grain-free, gluten-free, no preservatives). She regularly adds dietary supplements to her pet’s food to cover all her pet’s nutritional needs.

Helena does not often purchase pet food but is a good target for new technologies (dehydrated, freeze-dried, frozen). She is also willing to pay more for a diet that is better suited to her pet’s needs.

Meet Tess, the Tasty at a lower cost

Tess represents 7% of pet owners worldwide.

Living in a small city or in the countryside and more professionally inactive, Tess is enthusiastic and involved when choosing her pet’s food. Despite her low budget, her choice is primarily driven by taste. She gravitates toward pet foods that are both tasty and cheap.

Tess is the opposite of a control freak and finds that feeding her pet correctly is not so difficult. Tess feeds her pet with many types of pet foods (dry kibble, wet food, treats), leftovers and even homemade dishes. She purchases low-priced to mid-priced brands at the super/hypermarket, online or at the discounter.

Tess has no real interest in the content of the products she purchases. She’s seeking out balanced, nutritious and palatable foods that are easy to digest. She is one of the least willing to pay more for a diet that is better suited to her pet’s needs.

* Source: LOOP survey Yummypets “Inside a pet parent’s mind” – Survey conducted in France, UK, USA, Canada, Brazil and Mexico with 2,669 respondants – January 2024

Take-home points

* required fields