This article explores how the pet food world will evolve in the near future and beyond by identifying major themes that will unlock opportunities that matter for the industry.

Near future: what will be driving pet food innovation in the next two years?

Nature versus science

Pet humanisation fuels the convergence of two powerful dynamics: the tendency of pet owners to apply their own dietary preferences to their pets and veterinary science. The natural movement has gained traction over the last few years as all-natural pet foods accounted for 9% of the global market in 2020, with the number of pet food launches increasing by 41% between 2016 and 2020. Despite this, 72% of UK pet food buyers think that pets shouldn’t follow the same diets as people.

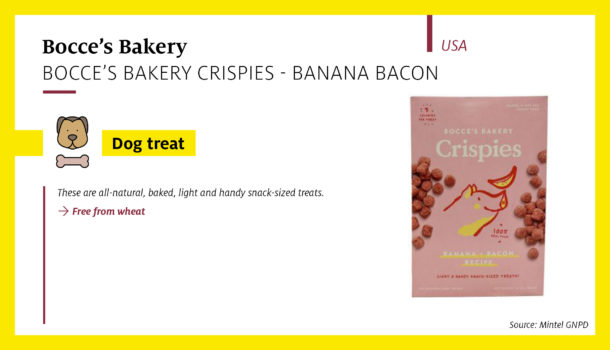

On the one hand, consumers focus on their own health and proactive, holistic nourishment will mirror their aspirations for their pets, creating a growing interest in niche botanical ingredients and natural functionalities.

However, pet diets will remain under scrutiny as pet owners are also more and more undecided with regards to the role of pet diet in pet health (ie grain-free). In this context, Mintel predicts that science-led diets will appeal to global pet owners seeking enhanced nutritional value. This includes, for example, the 76% of German pet owners who are actively looking for digestive health for their pet’s overall health, as well as the 47% of US pet owners who would like to see more pet food/treats providing added nutrition (2019).

There are opportunities for brands to move towards a balance between nature and science. With increasing knowledge, pet owners will become more discerning in choosing the appropriate nutrition for their pets, creating new opportunities for brands to leverage their science-based strengths. As functionality is among the primary choice factors for many pet owners, brands should harness the potency of botanicals and other ingredients that are often promoted for their ‘super food’ or ‘adaptogenic’ properties in human food and drink – and transition them into pet food. Adaptogens refer to natural ingredients that claim to help the body adapt to physical and mental stress.

The feline revolution

People are increasingly opting for small, easy-to-care-for pets without serious ‘babysitting’ commitments. Cats are regarded as more convenient and suitable for the busy lifestyles of urban dwellers, and increasingly men. Cats are also cheaper to provide for than dogs. As Millennials forge a stronger bond with their cats, pet food brands will give more attention to felines, encouraging cat owners to invest more in the health and happiness of their cats. Finally, some scientific evidence suggests that cats offer unique emotional, psychological (PLOS study publication, France, 2012) and even physical health (Study by the University of Minnesota’s Stroke Institute in Minneapolis, 2008) benefits to their owners.

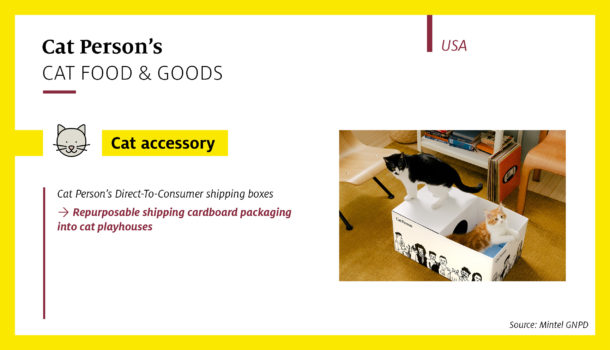

The COVID-19 pandemic has given a huge boost to e-commerce, including for pet food, with the direct-to-consumer (DTC) trend reaching the pet food industry in a big way. Forward-thinking pet food brands have reinvented cat food packaging, creating a strong visual identity and elevating distinctive attributes in a fresh, bold and minimalist way. For example, DTC cat food startup Smalls describes their product packaging as cool, innovative and straightforward, while also maintaining a very tight, clear lockup of the nutritional facts cat owners care about

A green future

The number of launches making ethical and environmental claims is growing in pet food to reach 21% of all pet food launches in 2020 globally. The awareness and interest in this space is set to grow, with more pet owners becoming interested in green choices for their dogs and cats. For example in 2020, 53% of UK pet food buyers find pet food made using sustainable ingredients appealing. This will also impact a variety of claims related to the high standard of ingredients such as animal welfare or the emphasis on more ethical and local sourcing strategies.

Aligning sustainability and nutrition will also be increasingly important. The casting of meat by-products as undesirable has helped fuel the premiumisation of the category but may have made it more difficult for premium brands to shift back to more responsible sources of animal protein, such as by-products. One notable effort in this direction is Merrick Full Source, which the brand describes as “full nose-to-tail, utilizing more of the animal for a sustainable, nutrient-rich meal”.

Looking ahead, pet owners will also focus on their pets’ carbon footprint. Finnish start-up Alvar Pet was early to identify this white space and offers carbon-neutral dog food subscription to help dog owners decrease their dogs’ carbon paw print without compromising nutritional quality or service. Alvar Pet acts sustainably in every step of the operational chain, substituting conventional dog food ingredients with locally sourced Nordic ingredients.

Rising popularity of plant and alternative proteins

Lastly, plant-based ingredients and alternative proteins are a trending topic amongst pet food producers and becoming more mainstream in the pet food market – not least because of their lower environmental impact. Pet food companies will be embracing novel protein sources, with algae, yeasts and insect proteins just some of the alternatives to consider. UK-based startup Aardvark, for example, attracted more than 900 investors in 2020 to fund the brand’s plans to bring to market planet-friendly pet food made with sustainable insect protein. In the US, Jiminy’s features research showing that cricket protein supports a healthy, balanced level of gut bacteria diversity (gut microbiome) in dogs.

Beyond: what will be inspiring brands in the five years and beyond?

Enhance emotional connections

The widespread tendency of pet owners to self‐identify with their pets will continue to strengthen the human-animal bond, opening up new forms of connections and engagement opportunities within every business sector. In search of stimulation and emotional connections, consumers will look for products and experiences that function as an invitation to bond with their furry friends in novel ways.

In particular, we anticipate that leading and niche food and drink brands will continue to explore how to engage pets in indulgence or treat-based categories. In the US, for example, Ben & Jerry’s has recently released a new line of ice cream exclusively for dogs, while CBD beverage brand Recess has introduced a new line of merchandise called ‘The Walk Collection’ which includes CBD dog treats. Peru has also recently seen the launch of ‘Doggy Pops’, a frozen treat that is suitable to be eaten by both humans and dogs.

Focus on mental health

While many studies are still exploring the impact of COVID-19 on pet behaviour, there are indications that the pandemic may also be affecting pets. For example, a recent British study from the Dogs Trust exploring the effect of COVID-19 on dogs and their owners found increased reports of dogs’ undesirable behaviours during lockdown. It is also widely anticipated that many pets will experience separation-related problems once their owners return to work and they find themselves home alone.

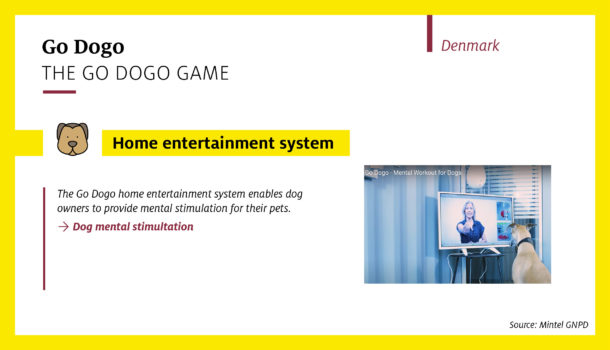

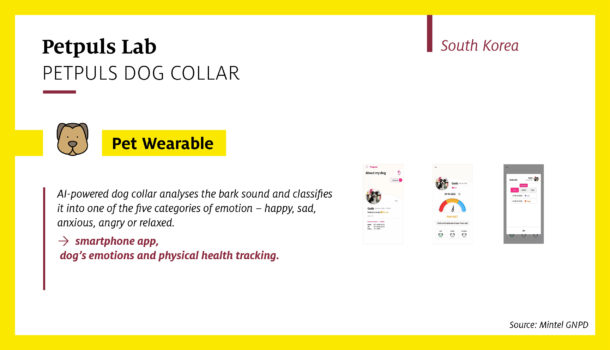

Innovative brands and apps are already playing the emotional wellbeing card in particular for dogs. For example, the AI-powered emotion-detecting dog collar developed by South Korean start-up Petpuls Lab analyses the bark sound and classifies it into one of the five categories of emotion: happy, sad, anxious, angry or relaxed. The Go Dogo home entertainment system developed in Denmark enables dog owners to provide mental stimulation and workouts for their pets. Dogs enjoy earning their food, and through the Go Dogo system they can solve stimulating and fun challenges in exchange for treats.

Explore the potential of lab-grown meat

Lab-grown protein for pet food has been in the spotlight quite a bit in recent years, with companies such as Bond Pet Foods, Wild Earth and Because Animals all working on developing various technologies to grow meat in labs. These products will appeal particularly to the Millennial pet owners. Indeed in the UK in 2020, 30% of pet food buyers claim they are interested in pet food made with lab-grown meat, with the acceptance peaking among young adults aged 16-34.

With many Millennials already reducing their own meat intake, they will inevitably turn their attention to what they feed their pets. Therefore, the real opportunity for lab-grown pet food is to address Millennial pet owners’ concerns for the environment and animal welfare, while providing their pets with optimal nutrition.

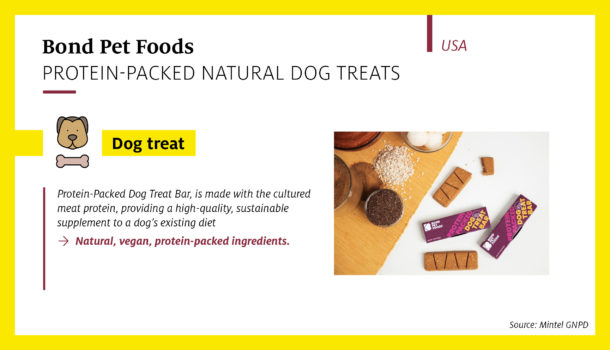

Bond Pet Foods, for example, has been experimenting with biotechnology to make animal-free and protein-rich pet food. The company implements the same fermentation technology that is used to produce ingredients for cheese making or insulin for diabetics to instead harvest high-quality meat proteins, but without the animal. Its first product, the Protein-Packed Dog Treat Bar, is made with the cultured meat protein, providing a high-quality, sustainable supplement to a dog’s existing diet.

Consumer data source: Lightspeed/Mintel

Take-home points

* required fields