2020 has been a successful year for pet food sales in North America. The e-commerce distribution channel strongly benefited from the COVID situation in the US and Canada as well. In the US, the online pet product sales share jumped from 24% in 2019 to 30% in 2020 and according to experts, that share is expected to soar to 53% by 2025*. In Canada, the number of pet owners buying online has increased by 33%**. Online shopping and ship-to-home allowed households to take more time to select food for their loved ones, with a higher choice of products, and also more customization options.

Last year has also demonstrated a shift in pet ownership. According to Euromonitor, the pet population has grown by 5% in North America, with a major increase in high-revenue households, leading premium pet food to gain market share. This can be a reason for the diversification of pet food formats observed in past months; for example, the many “new wet” products such as stews, purees, patés and broths.

Owners spending more time at home with their pets, combined with rising concerns about sustainability and health due to the pandemic, have also contributed to emerging trends for innovations in North America.

Let’s have a look at pet food global market trends illustrations observed in NAM last year.

*Packaged Facts

** Nielsen, PIJAC presentation

Natural Goodness: the future of pet food is sustainable protein

This major trend encompasses three distinct expectations of consumers. First, a desire for better-sourced ingredients and packaging with claims such as “non-GMO,” “Certified Humane” or “Humanely raised” and “locally sourced.” Pet owners are also looking for purer and simpler ingredients, which are minimally processed or even raw. And lately, brands are becoming more creative in answer to the demand for alternative proteins or plant-based recipes.

We can observe some good illustrations of this trend in recent launches such as vegetarian food for dogs, plant-based or insect-based diets, or recyclable packaging.

Premium Indulgence: humanization is still leading innovation

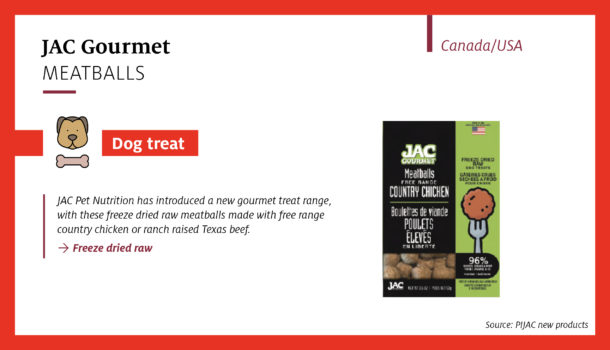

The premiumization trend opens the path to craft creations produced artisanally, in small batches with human-grade products, gourmet-style food, and elaborate menus.

Products meant to improve a meal experience, such as meal toppers, continue to appear on the market. These innovations offer pets a gourmet meal, developing the culinary attributes by playing on new textures and formats such as frozen, dehydrated, fresh, freeze-dried, or broth, often available in individual size portions. In 2020, the claims with the highest growth were “freeze-dried”, “frozen” and “dehydrated”.*

Personalization is also a rising trend, with highly customized and ready to prepare kits. The customized and “fresh cooked” trend gained importance due to the strong increase of online sales and opportunities for manufacturers to launch direct-to-consumer options, by-passing usual distribution channels, according to Euromonitor.

That led to products that appeared more “humanized” thanks to premium packaging and ingredients.

*Nielsen presentation PIJAC

Healthy lifestyle: when the pandemic boosts concerns

According to a Packaged Facts survey conducted at the end of 2020, 42% of U.S. dog owners and 43% of cat owners said they pay closer attention to their pets’ health because of the pandemic. Pet wellness is still a major concern for pet owners, who look for preventive care diets to improve their companions’ weight management, immune system, digestion or coat by including natural superfoods, prebiotics or probiotics.

Performance diets with high protein content and healthy fats are also popular for pet owners who want to boost their pet’s performance.

To satisfy the needs of more sensitive pets, the “free from” trend has brought the emergence of milk replacement with goat milk for puppies and kittens.

Emotional discovery: providing for new experiences while staying home

The ongoing humanization trend, fostered by the fact that owners spent more time at home with their pets in 2020, has led to an impressive rise in the treat segment in the US *.

Brands now recognize that the new generations of owners, such as Millennials, represent a very enthusiastic category of pet parents, who put their pets first and are ready to invest in their pets’ food. To address this category of consumers, manufacturers understand they need to create fun, photogenic and colorful products, linked to youthful, iconic brands.

Moreover, in 2020, when traveling and celebration options were limited, consumers wanted to participate in new cultural and emotional experiences with their furry companions to escape the stressful COVID situation.

*Nielsen presentation, PIJAC

Last year’s events, leading to major changes in habits and lifestyle, seem to have created great opportunities to boost existing trends. Pet food manufacturers seized this opportunity, proposing creative products matching even more human food trends than before.

Data Source :

– Euromonitor International

– Packaged facts

– Mintel GNPD

– State of the US & Canadian Pet Industry: Trends & Insights (Nielsen, PIJAC April 2021)

Take-home points

* required fields