Luying Wang, Symrise Pet Food APAC Marketing Coordinator and Arnaud Savarin, APAC Nutrios Product Manager went along to discover some of the key trends. They share their insight and analysis of the key product trends at the show, including: the main drivers behind the premiumization of China’s pet food market; how domestic brands are appealing to new generations of pet parents; and how the humanization of pet food is driving innovation.

Three trends shaping the premiumization of China’s pet food market

There are three main axes being developed by manufacturers to emphasize product quality and achieve a more premium positioning for their pet food products.

Development of alternative processes

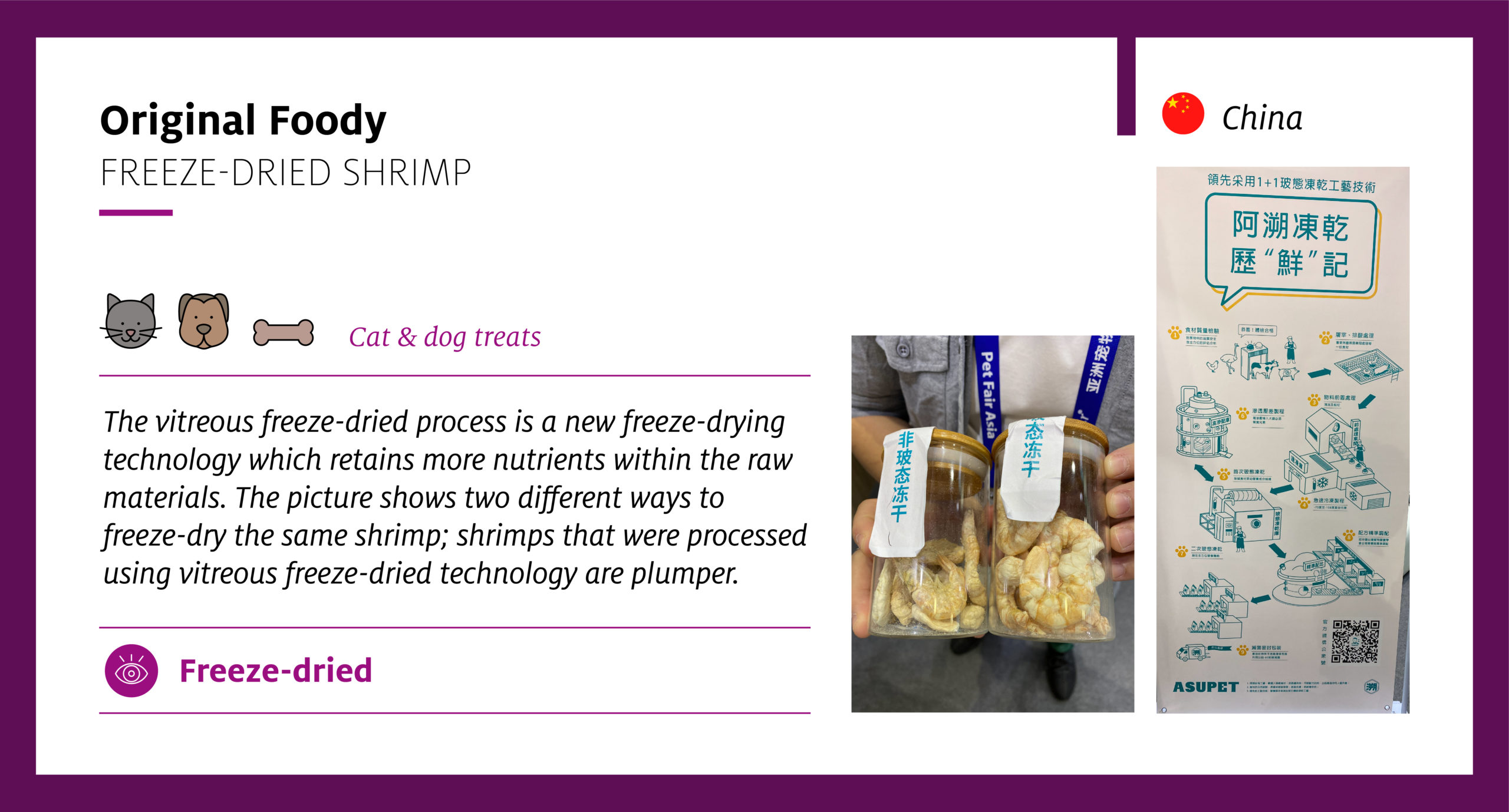

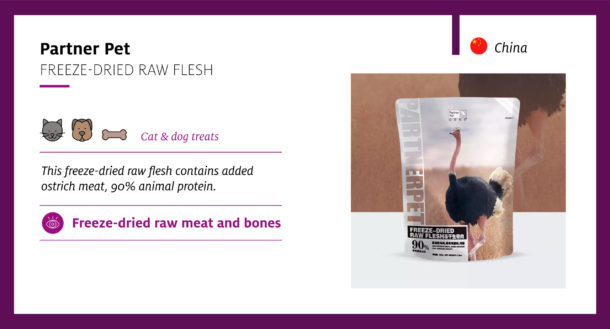

The first is the development of alternative processes such as freeze-dried, which allows for more natural, fresh products with less preservatives and visible ingredients.

Freeze-dried products are also healthier as this gentle process allows for better preservation of nutrients. This positioning prevailed over the more classical “less preservatives” claim in products observed, which potentially meet the new Chinese regulation expecting more substantial evidence of product naturality. Some brands even claim that they use wholesome meat to produce high quality freeze-dried food.

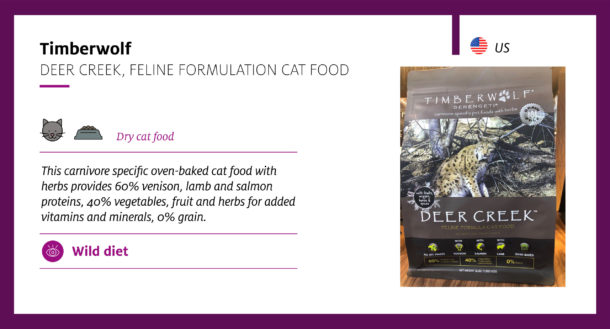

The process was widely used on the entire product or as an ingredient for treats and a complete food diet. This technology, as well as dehydration, is also being used to bring real pieces of meat, fruit and veg into the blend. Other processes such as oven-baked and low temperature cooking were also part of the alternative processes seen during the fair.

Over the last two years, the trend has been for extrusion kibbles plus one kind of freeze-dried cube. But this year, there were more than three to five different kinds of kibbles in one pack, for example, freeze-dried salmon, seaweed particles, freeze-dried beef and freeze-dried egg yolk. Overall, the result is a more colorful collocation.

New functional ingredients

The second trend observed at the show was a much wider use of new functional ingredients to support health claims. The ingredients addressed well-established claims, such as digestive health, but also more recent and modern concerns, such as immunity or stress management. These new ingredients also allow for legitimate positioning with tangible proof, resulting in better informed pet owners.

Protein sourcing innovations

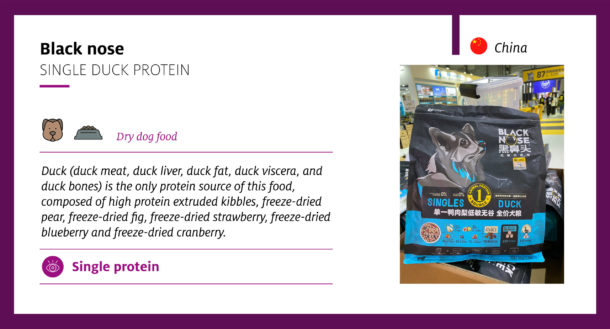

The third trend that really stood out was the introduction of new protein sourcing innovations. On a basic level, the aim is to bring variety into the bowl – cultural curiosity – but also, to project a natural image with a wild positioning or to find sustainable alternatives to existing ingredients. Another motivation for the rise in new protein sources is to address sensitivity issues with exotic protein sometimes incorporated as a single source to reduce allergenic effects.

Domestic brands with next generation appeal

It’s clear to see that manufacturers understand the importance of seducing the new generations of Millennials and Gen Z, who are particularly enthusiastic to consume on behalf their pets. This is why, in order to compete with the high number of foreign brands that want to break into the Chinese market, local brands – even traditional, reputable ones from pet care to pet food – are innovating to satisfy this segment of the population.

Their aim is to develop a more youthful, new look for their products that respects not only the consumer demand for good quality but also better value for money, while, at the same time, delivering a more impactful, funny design. As well as developing visually appealing products, they are also looking to engage their fan base via social media communication.

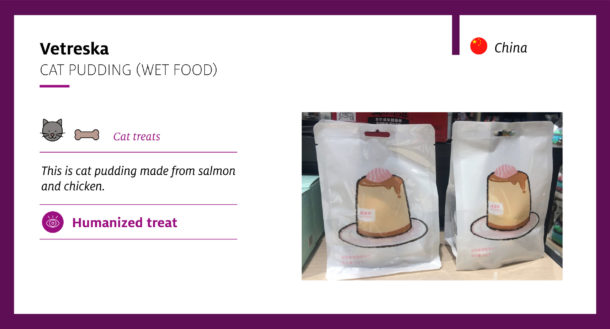

Humanization drives innovation

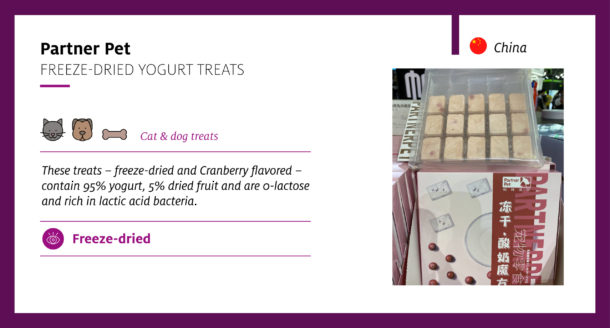

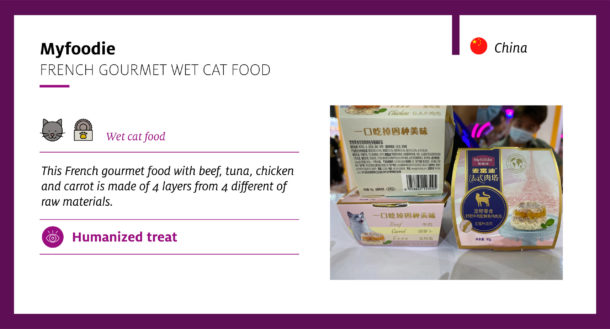

Humanization remains a strong driver of innovation. Some examples include: the treats format mimicking human food codes; proposing a culinary experience with gourmet wet recipes; and the possibility of personalization with DIY options or topping sauce.

There was also evidence of a sudden outbreak of liquid food products this year, examples included milk and yogurt and even tea and soup!

Header image by Pet Fair Asia

Take-home points

* required fields