The increasing humanization of pets in the region points towards opportunities for pet food innovations. Additionally, Pet owners in Latin America are keen to explore functional health options for their pets in addition to supporting sustainability initiatives.

This article explores how the pet food industry in Latin America will evolve by identifying key commercial opportunities.

LATAM pet food: a booming market

In many LATAM (Latin American) markets like Argentina, Brazil, Chile, Peru and Colombia, pet adoptions increased during the pandemic. Brands and retailers are responding to this booming market with significant investment in the pet space. Nestlé Purina Mexico has invested US$160 million to expand its Guanajuato factory. Brazilian pet shop Petz acquired ecommerce and content platform Cansei de Ser Gato. Unilever chose Brazil to launch Cafuné, its first ever pet care brand.

Pets and their owners: a precious relationship

A number of lifestyle changes across Latin America are contributing to the rise in the status of pets; three quarters (75%) of Mexican consumers now have a dog in their household. Across Latin America, birth rates are declining and one-person households are growing. Divorce rates were on the rise prior to the pandemic and increased even more due to lockdown orders.

In addition, pet companionship matters more than ever in a time of economic uncertainty and increased isolation. Studies show that pets lower humans’ blood pressure and reduce feelings of anxiety, loneliness and depression. In the modern era, that bond has grown much more intimate, with people giving their dogs and cats clothes, toys, social media accounts and a spot on their beds.

Expand shared occasions

There is an increased development of products and services for pets that mirror those normally targeted at humans. Pet owners spending a large amount of their income on products and services for their beloved four-legged companions is nothing new, but such expenditure is now extending beyond basic goods: consumers are aiming for their pets to have access to premium services, treating pets in the same way that they treat themselves.

In Summer 2022, a festival mainly for pets and their owners was organized in Argentina by pet supplier Puppies. The festival was held in a shopping mall parking lot and featured games, music and shows just for pets, as well as different stalls retailing pet-related products.

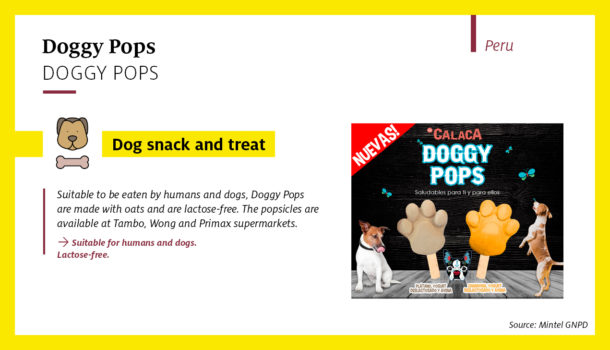

There is also an opportunity to expand shared meal occasions with products like cooking mixes or meal duos that help pet parents celebrate the importance of their pets and what they add to the family.

View pets as potential foodservice customers

Breweries, cafés and burger joints’ casual atmospheres often welcome pets. Innovative food and drink concepts aimed at pets are helping some outlets transition from accommodating pets to considering them as real customers who are hungry for more.

Look after the environment by supporting local

Latin American pet owners care a lot about the environment. In Peru, 32% of cat owners and 30% of dog owners say that the environment is among the things they worry the most about. Pet products can add eco-friendly claims to attract pet owners who are concerned about the environment and already plan to buy human food/drink in eco-friendly packaging.

Pet owners in the region are also seeking locally made products as they look to support their local economies. The next step will be to connect local sourcing with low carbon emissions to meet the needs of climate-savvy consumers.

Tackle food waste with upcycled, nutritious ingredients

Considering Latin American consumer interest in avoiding food waste, there is also room for pet food made from ingredients which otherwise would have been discarded.

Pet food brands are well positioned to leverage the upcycling trend. Traditional pet fare is made of byproducts from the human food chain, with meat byproducts being a prime example of preventing loss or waste from the human food stream. Yet upcycling messages have not meaningfully manifested in pet food products to date, suggesting an opportunity gap.

Add value to wet food through functionality

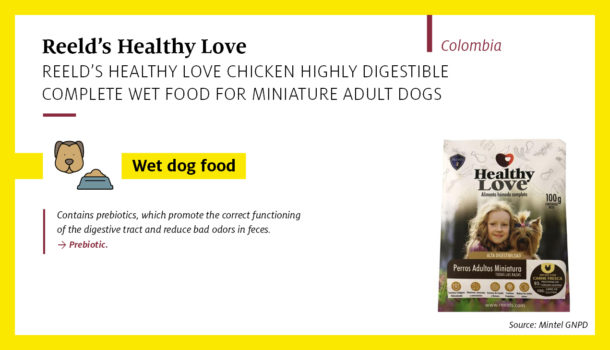

The humanization of pets in Latin America is already leading to greater interest in food that better meets pets’ nutritional needs. Functional health benefits such as claims relating to digestion and eyesight are very common in dry pet food launches in Latin America but far less common in wet pet food.

Brazilian pet owners buying wet food are more likely to seek functional health benefits (eg healthy teeth, shiny coat) than pet owners buying dry food. However, almost one in five (18%) of Brazilian pet owners usually don’t buy wet food because it is too expensive. There is an opportunity for wet food brands to offer more value through the addition of functional health benefits.

Add supplementary nutrition through pet food toppers

Pet owners have long mixed pet food with other foods to encourage consumption. However, brands are now promoting the use of toppers created specifically for the purpose. Initially used to make pet food more palatable, pet food toppers are increasingly used to add health benefits and examples are emerging in Latin America.

Take-home points

* required fields